The white goods market in India is experiencing robust growth driven by technological advancements.

One of the primary reasons is that rising disposable incomes, evolving consumer preferences, and urbanization in the industry are leading to demand for household appliances.

The evolving way of life for indian consumers, coupled with a strong desire for ease and practicality, is driving more and more people to buy white goods.

Simultaneously, with heightened awareness about environmental issues and the cost of energy, there’s a clear shift towards choosing appliances that use less power.

This preference for energy-efficient options not only helps consumers lessen their environmental impact but also leads to savings on their electricity bills.

Consequently, manufacturers are responding by offering a wider range of energy-saving models, and these products are seeing increasing popularity in the Indian market.

Vicino helps refine your market research strategy so you can make smarter decisions and stay ahead of the competition.

Key Takeaways about the Indian White Goods market:-

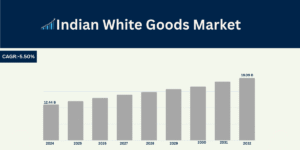

- The Indian white goods market is experiencing substantial growth, with projections indicating it will reach US$21 billion by 2025.

- The industry anticipates a 10–15% growth in 2025, driven by the premiumisation trend, which reflects a shift towards higher-end, energy-efficient, and connected products.

- Domestic manufacturing contributes nearly US$ 4.6 billion on average to this industry.

- The Global white goods market is expected to reach US$1573.3 billion by 2034 and grow at a CAGR of 8.4%.

The indian white goods market presents significant opportunities driven by economic growth, evolving consumer preferences, and technological advancements, with a clear emphasis on energy efficiency and smart features shaping future demand.

White Good Market Drivers:-

Rise in disposable Income

The rising disposable income of Indian middle-class households is the major factor driving growth. As income rises, more households can afford appliances like refrigerators and air conditioners, leading to a significant increase in demand.

The trend is widely popular in urban areas where the population is expanding rapidly and consumers have greater purchasing power. People are opting for advanced appliances, replacing outdated products.

Rapid Urbanization

The rise in urbanization, changing lifestyles, and higher living standards leads to an increase in demand for household appliances.

The construction of housing complexes and apartment buildings increasingly includes provisions for modern amenities, including white goods such as refrigerators, washing machines, and air conditioners.

Challenges of the White Goods Market:

1. Supply Chain Constraints

An increase in demand for goods puts the load on imported components such as chips, compressors, exposing appliance manufacturers to global supply chain vulnerabilities.

Disruptions caused by geopolitical tension, logistic challenges cause issues like an increase in cost, and limited availability of the product in the market.

2. Lack of Infrastructure

An unreliable electricity supply in many parts of India continues to hinder the adoption of white goods, as consumers are hesitant to invest in appliances that require a stable power source.

Additionally, the lack of proper waste management systems raises concerns about the disposal of old or obsolete appliances, further discouraging new purchases.

These infrastructure gaps pose a significant challenge to the growth of the white goods market, especially in rural and semi-urban areas where such limitations are more pronounced.

Market Scope Report and Segmentation

| Report Metrics | Details |

| Market Value | $757.72 Billion |

| Forecast Revenue | $1573.3 Billion |

| CAGR | 6.5% |

| Forecast Period | 2025-2031 |

| Base Year | 2024 |

| Previous Forecast period | 2023 |

| Quantitative Units | Revenue in USD Billion, Volume in Units, Pricing in USD |

| Segments Covered | Product(Refrigerator, air conditioner, Washing Machine, Dishwasher, microwave, and oven). End user(Residential and commercial) Distribution channel( E-commerce, supermarket, and hypermarket) |

| Regional Analysis | Latin America ( Brazil, Mexico, Rest of Latin America), Asia Pacific (China, Japan, South Korea, India, Australia, Singapore, Rest of APAC), North America (US, Canada, Europe, Germany, France, The UK, Spain, Italy, Rest of Europe) Middle East & Africa ( South Africa, Saudi Arabia, UAE, Rest of MEA), |

| Market Players Covered | Dyson (U.K.), Panasonic Corporation( Japan), Messermeister (Germany), KAI USA LTD (U.S.), Samsung Electronics Co., Ltd, L.G. Electronics (South Korea), Kiya Corporation (Japan), Sharp Corporation (U.S). |

| Market Opportunities |

|

Competitive Landscape and Market Share Analysis: Indian White Goods Market 2025

Market Concentration

- The Indian white goods market is highly concentrated, with the top 5 companies controlling 70% of the market share.

- Major appliances (refrigerators, air conditioners, ovens) form the largest segment with a projected market value of US$42.17 billion in 2025.

Key Market Leaders

Leading brands in India’s white goods sector include:

- LG Electronics

- Godrej

- IFB Home Appliances

- Blue Star Limited

- Hawkins Cookers Limited

- Haier Group

- Electrolux AB

- Whirlpool Corporation

Market Growth

- The overall appliances and consumer electronics industry in India expects 10–15% growth in 2025, driven by premiumisation and rising demand for smart, energy-efficient products.

- The market is moderately concentrated for major appliances, such as washing machines, refrigerators, but highly fragmented by kitchen appliances, such as microwaves, ovens, air fryers, chimneys, etc.

Product Segment (Globally)

- Globally, refrigerators lead the white goods segment with about 40.6% market share, followed by cooking appliances, washing machines, and air conditioners.

- In India, a similar observation is made, with refrigerators, washing machines, and air conditioners dominating sales.

Consumer Survey Insights: What Indian Buyers Expect from After-Sales Service

To understand what customers expect from white goods brands, we conducted a nationwide survey in early 2025. The survey focused on things like:

- What appliances do people own

- How happy they are with customer service

- How do they use after-sales support

We gathered responses from people with different incomes, jobs, and from cities across India. The results give a clear picture of what real customers are experiencing and what they want to see improved.

Get the full survey report to understand what Indian consumers expect from white goods brands after they make a purchase.

- Find out what problems people face with the service

- See which brands customers are most happy with

- Get honest feedback and useful tips to improve your service

Key Players and Market Structure

| Segments | Market Share | Major Players |

| Major Appliances | >70% | LG, Godrej, IFB, Blue star, haier, whirlpool. |

| Kitchen Appliances | Fragmented | Regional and International Brands |

White Goods Market Segment

The white goods market is segmented based on product, applications, and distribution channels.

The growth across these segments enables a thorough analysis of high-potential areas within the industry, offering users valuable market overviews and insights.

This information supports strategic decision-making by helping identify key market applications and core opportunities.

By Product

- Refrigerator

- Cooking Appliance

- Dishwasher

- Air Conditioner

- Microwave

- Washing Machine

By Application

- Commercial

- Residential

By Distribution Channel

- Supermarket

- Hypermarket

- Speciality Store

- Retail Stores

- E-commerce

Research Methods

Vicino is an excellent market leader in advanced factorial research. We provide the best services to our existing and new consumers with data and analysis that fulfill their needs and goals.

We can provide information and data with facts and numbers about many of your competitors and, if you want, through our market research services. Our team focuses on detailed information, how it will impact your market and industry, the key trend analysis, and what are the factors that drive success.

Frequently Asked Questions:

Q1: What is the current size of the Indian white goods market?

Ans: As of the latest estimates (2024-2025), the Indian white goods market is valued at over INR 80,000 crore (USD 10 billion) and is expected to grow at a CAGR of 8–10% over the next five years.

Q2: What is the growth outlook for the Indian white goods market?

Ans: The market is expected to grow steadily due to rising disposable incomes, urbanization, and government initiatives like Make in India and PLI schemes.

Q3: What challenges does the industry face?

Ans: Major challenges include high import dependence for components, price-sensitive consumers, and fluctuating raw material costs.

Q4: Who are the major players in the market?

Ans: Key companies include LG, Samsung, Whirlpool, Godrej, Voltas, and Haier.

Q5: What are the growth opportunities in this market?

Ans: Opportunities lie in rural expansion, premium product segments, and eco-friendly appliances.