Table of Contents

ToggleYou have an amazing startup idea in India, but you need help financially.

Getting money can seem like a complicated process in India’s growing startup economy.

This guide takes you through a number of funding options and offers helpful guidance to help you get funding for startups in India so that your business can succeed in this competitive market.

Firstly know about funding!

What is Funding?

Funding refers to the financial resources provided to start or grow a business.

For startups, funding is important as it helps cover initial expenses, develop products, and scale operations.

It can come from various sources, such as personal savings, friends and family, angel investors, venture capitalists, crowdfunding, bank loans, and government grants.

Securing adequate funding is essential for turning a business idea into a successful and sustainable venture.

It can come from various sources, such as personal savings, friends and family, angel investors, venture capitalists, crowdfunding, bank loans, and government grants.

Securing adequate funding is essential for turning a business idea into a successful and sustainable venture.

Why Funding Is Essential For Startups?

For startups, funding is essential since it offers the capital required to turn concepts into successful ventures. Here’s why having money is crucial:

Initial Setup Costs: Establishing a business entails several costs, including registering the organization, leasing space for offices, buying equipment, and creating goods and services.

The funding contributes to these upfront expenses.

Product Development: Research, development, and testing costs must be expended to create a good or service.

Sufficient investment guarantees that companies can improve their products and get them ready for the market.

Marketing and Sales: Startups must invest in marketing and sales initiatives to attract clients.

This includes promoting their products/services and establishing a strong online presence.

With funding, startups can effectively reach their target market.

Talent acquiring: Hiring qualified workers is a must for expansion.

With the help of funding, companies can offer attractive compensation and benefits to draw and keep the best employees.

Operations Scaling: As a business expands, operations scaling becomes essential.

This involves raising output, breaking into unexplored markets, and enhancing infrastructure.

Funding provides the resources required for effective scaling.

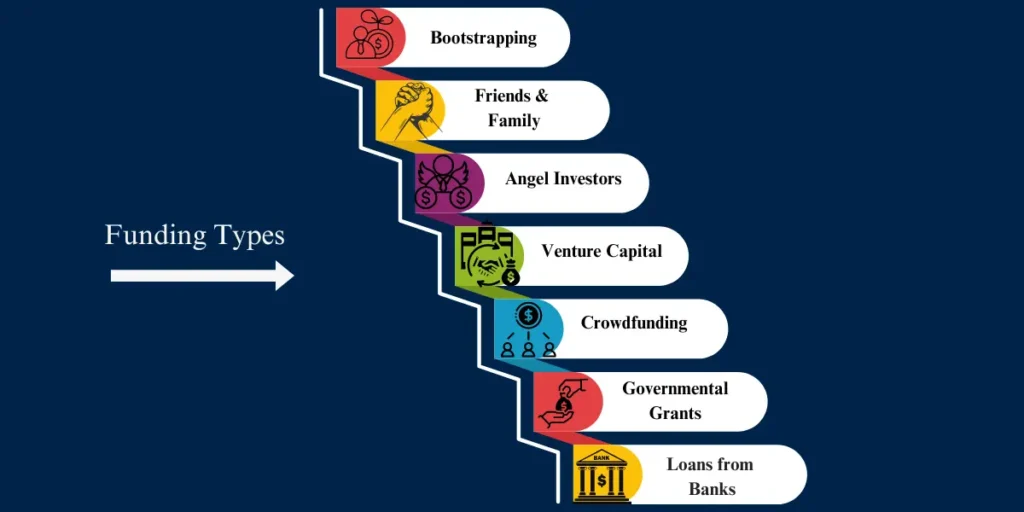

Types of funding

While exploring you get a question in your mind about how to raise funds for a startup business in India.

When starting a business in India, various types of funding options are available to entrepreneurs.

Selecting the ideal startup financing strategy might be made easier if you are aware of these possibilities. Here are some common types of Funding for startups in India:

1. Bootstrapping

Using your personal savings to launch your firm is known as bootstrapping. It’s a popular option among entrepreneurs because it lets you keep total control over your business.

Since you are investing your own money, it could be risky.

2. Friends and Family

This kind of capital originates from your personal connections. Because they believe in you, friends and relatives may be prepared to invest in your project.

Even though this can be a simple and quick approach to gathering money, it’s important to put the agreement down on paper to avoid confusion.

3. Angel Investors

Angel investors are those who lend money in return for debt that can be converted into equity or ownership.

In addition to financial support, they provide beneficial industry connections and mentorship. You need a great business strategy and an engaging proposal to draw in angel investors.

4. Venture Capital

Startups with significant growth potential are invested in venture capital (VC) firms. They offer substantial financial sums in return for equity.

VCs can assist in quickly scaling your company, but they frequently demand significant influence and a well-defined exit plan.

5. Crowdfunding

Crowdfunding is the process of collecting small amounts of money from a large number of people via Internet locations, usually. Different forms of crowdfunding exist, including:

Reward-based: In exchange for their contribution, backers get a good or service.

Equity-Based: Your business issues shares to investors.

Donation-Based: Backers make monetary contributions without anticipating anything in return.

6. Governmental Grants and Schemes

The Small Industries Development Bank of India (SIDBI), Startup India, and Mudra Loans are just a few of the initiatives the Indian government gives to help new businesses.

These programs and grants, which don’t require ownership, might offer crucial financial support.

7. Loans from Banks

Another possibility is standard bank loans. A strong business plan, a high credit score, and at times proof are required to obtain a loan.

Although they can be difficult to get, bank loans are a reliable source of money.

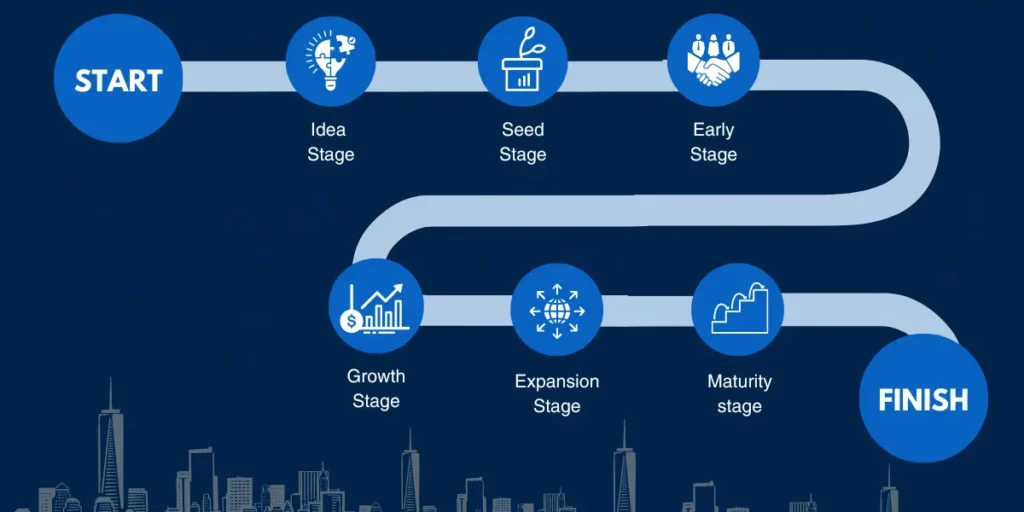

Stages of Startups to Raise Funds

Startups go through different stages of growth, and each stage presents unique opportunities to raise funds. Here’s a breakdown:

1. Idea Stage

- At this stage, you have a concept or idea for your startup.

- Funding usually comes from personal savings, friends, or family.

2. Seed Stage

- You have created a minimal viable product or MVP.

- Angel investors and early-stage venture capital firms are two sources of seed money.

3. Early Stage

- Your startup has gained some traction, with early customers or users.

- Funding may come from venture capital firms focusing on early-stage startups.

4. Growth Stage

- Your startup is scaling up operations and expanding its customer base.

- Venture capital firms specializing in growth-stage investments may provide funding.

5. Expansion Stage

- Your startup is well-established and looking to enter new markets or launch new products.

- Funding may come from venture capital firms or private equity investors.

6. Maturity Stage

- Your startup has achieved significant success and stability.

- Funding options include private equity, mergers, or acquisitions.

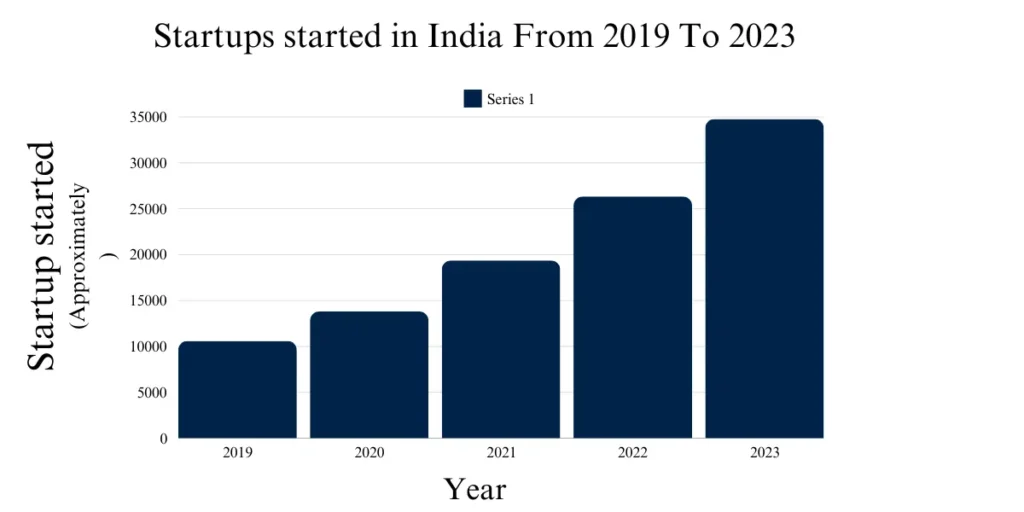

India’s Startup Boom from 2019 to 2023

Pros and Cons of Funding for Startups in India

Pros:

Access to Capital: Funding for startups in India offers the money needed to create new products, recruit staff, and expand operations.

Business growth: Makes it possible to quickly enter new product categories and markets.

Mentoring and Support: Investors provide insightful counsel, contacts in the business, and technical direction.

Credibility: Obtaining capital improves the standing of your business and draws in more clients.

Risk sharing: By sharing financial risks, investors reduce the load on founders.

Cons:

Dilution of Ownership: Funding for startups in India Indian startup entrepreneurs frequently give up some equity and hence some control over their company.

Performance Pressure: Investors’ high standards for speedy outcomes can be stressful.

Loss of Autonomy: Investors might desire influence over corporate choices and operations.

Potential for Conflict: Arguments due to founders’ and investors’ differing viewpoints may result in conflict.

Focus on Profitability: Startups may feel pressured to provide fast returns, which could lead them to put short-term profits ahead of long-term innovation.

Conclusion –

A key first step to achieving your dream of becoming an entrepreneur is securing funds for your startup in India.

You have many options, including bank loans, angel investors, venture capital, government grants, crowdfunding, bootstrapping, and help from friends and family.

Each type of funding has its pros and cons. External investors can provide money, valuable connections, and mentorship, while bootstrapping allows you to keep full control.

Bank loans offer a steady source of funds with specific terms, and government grants provide financial support without requiring collateral.

Dedication is crucial. Getting funding can be tough, but with persistence, careful planning, and the right resources, you can find the money you need to grow your business.

Stay updated on the latest trends and opportunities in the startup world, and don’t hesitate to seek advice from industry experts.

Vicino Tech offers expert guidance, market research services, and resources for aspiring entrepreneurs. Visit our website for detailed guides and tools to help you secure startup funding in India.